You might have seen some rumors on this already, but I wanted to help make everything clear for you...

A few weeks back I told you that there were some tax professional rumors circulating about “automatic PPP loan forgiveness” for loans under $150K. Remember that?

Well, they did it! Except it is for even smaller loans (under $50K).

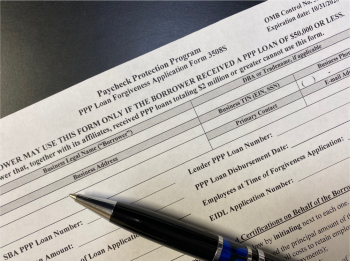

And it's not "automatic", but it is very, very easy. Here is the simplified application if your loan falls in that category.

The borrower needs to make various certifications -- that the spending meets at least 60% of PPP loan proceeds and attach verification of payroll costs and non-payroll costs. But you don't have to perform FTE (Full Time Equivalents) or salary reduction calculations. Owner wage limitations still apply of course.

It's essentially an affidavit for you to sign. (Under penalty of perjury, naturally.)

You just might want to contact the bank that funneled the PPP loan money to you in the first place and see if it's time for you to plow through the PPP loan forgiveness process.

There are some possibly good reasons for you to delay applying for PPP loan forgiveness, however, whether or not you have a loan under OR over $50K...

Firstly, there might be no tax advantage to having a PPP loan forgiven in certain cases. That means that there could be a situation in which you will save some taxation issues by posting all PPP dollars to a Long Term Liability PPP Loan account, and repaying the loan at 1 percent interest over two or five years. This may provide a greater tax benefit than losing deductions from what has been paid with the proceeds of the loan.

Secondly, there is still an outside chance the SBA will up the ante above $50K.

Or, even better, a revised ruling from the IRS stating that expenses paid with PPP dollars will remain tax deductible expenses. Some members of Congress have asked for this.

But I wouldn't hold your breath until we know what happens in early November -- you know, that *thing* that's happening then.

Thirdly, you might also want to have your "forgiveness" count in 2021, instead of 2020, depending on your planning projections.

(Oh, you don't have those projections? Call your tax pro after October 15th to set an appointment).

And one last thing you need to know ...

On October 2 the SBA issued some guidance on the issue of a borrower having a change in ownership. Now, that's interesting. They made it clear that if the borrower is not through with the forgiveness process, SBA pre-approval is required for transfers of more than 50% of ownership.

So, if you are selling your business and you received a PPP loan that has not yet been forgiven ... beware.

Not sure what "teeth" accompanies this new rule (they haven't clarified), but it is best to be forewarned, and go through the protocols if you're considering a transfer/sale.

These blog posts assure you, we're in your corner.

BE THE ROAR not the echo®

Warmly,

Janet Behm

Utah Real Estate Accountants

(801) 278-2700